Lesson Questrade Trading

Making a trade is easy and requires a few simple steps.

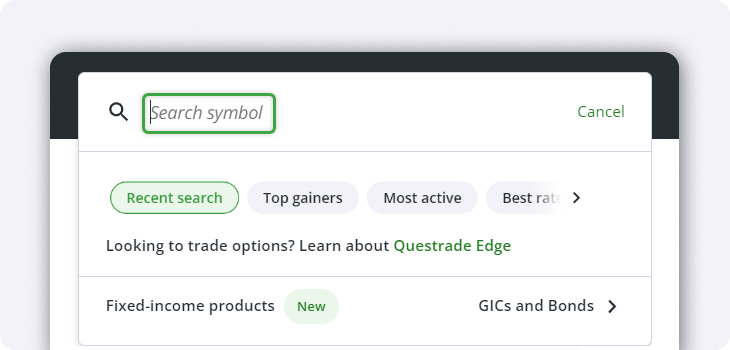

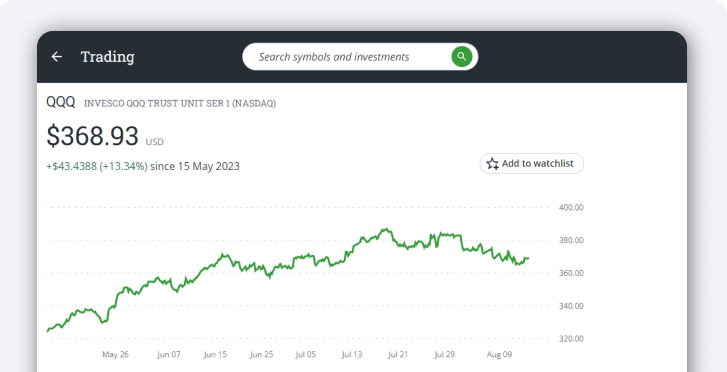

Head to the Symbol Lookup bar and enter the stock or ETF's symbol or name. A list will appear in the search box, and you can select the ticker symbol you wish to trade.

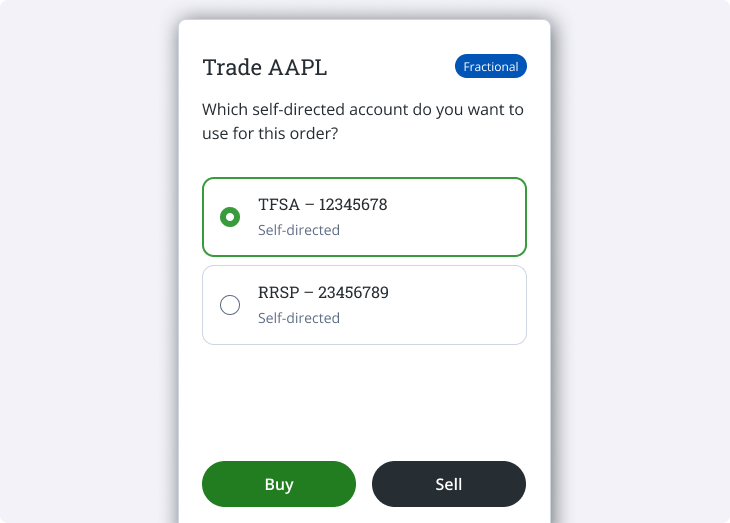

Choose the Buy or Sell button on the quote window.

- If you have multiple self-directed accounts, select which account you want to purchase or sell the security in.

From here, the order entry is slightly different depending on if you're buying or selling shares.

If you're buying shares:

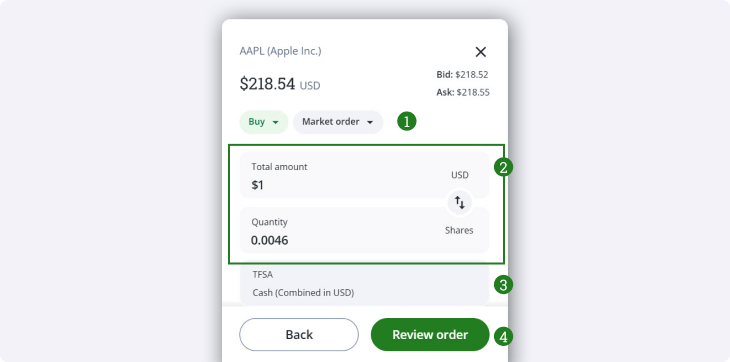

You will see the above order entry screen.

- Choose the order type from the drop-down at the top of the order entry.

- Market orders will immediately buy or sell shares at the best available price, and can buy fractional shares of applicable securities. For most users, this will be the default order type.

- Limit orders let you set the price at which you want to buy or sell the shares, and the trade will only execute at the target price or better.

- Note: Fractional shares can only be purchased or sold using Market orders.

Note: If you’re looking to use advanced order types (including trailing stop orders, bracket orders, etc.), please use Questrade Edge Web.

- Enter either the total amount you would like to spend, or the total quantity you would like to buy.

- - No matter the field you use, the other field will auto-populate with an estimated quantity or amount based on the current market price.

- If you are filling out a limit order, you will need to include both the quantity of shares you want to buy and the price at which you want to buy them.

- You can change the account you would like to use to place the order from the drop-down.

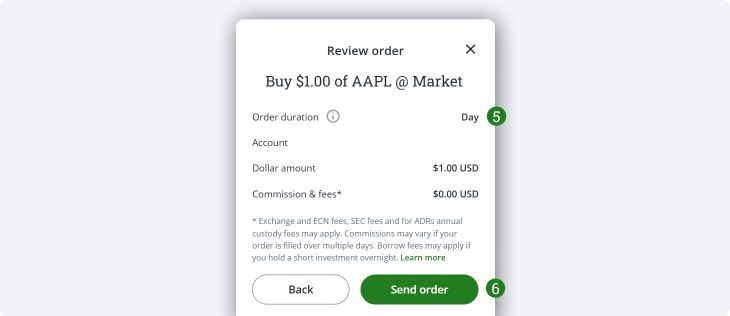

- After you review all the details, click Send order to place your trade.

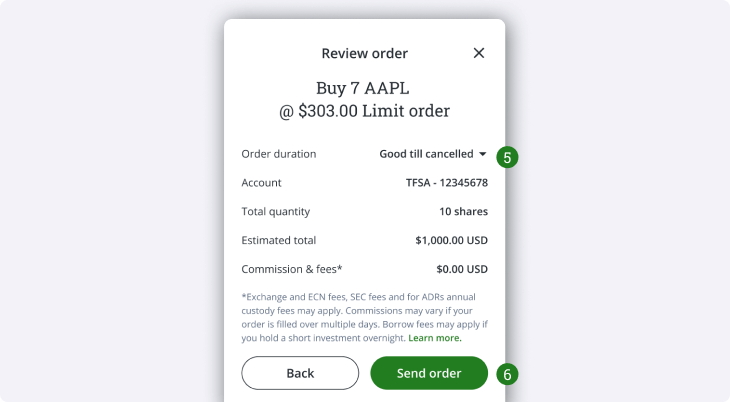

- If you are placing a limit order, you can use the drop-down here to set the order duration.

- If you’re satisfied with the order details, click Send order to place your trade.

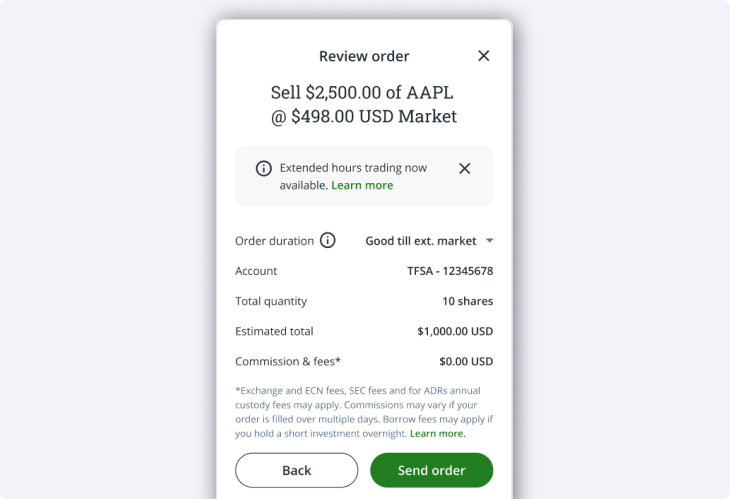

If you're selling shares:

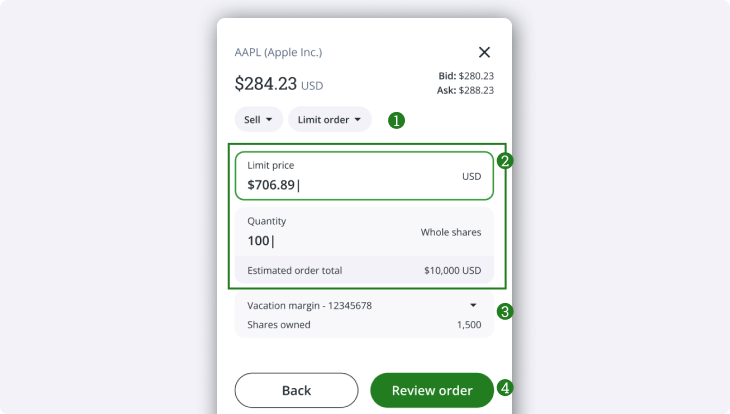

You will see the above order entry screen.

- Choose the order type from the drop-down at the top of the order entry.

- Market orders will immediately buy or sell shares at the best available price, and can buy fractional shares of applicable securities. For most users, this will be the default order type.

- Limit orders let you set the price at which you want to buy or sell the shares, and the trade will only execute at the target price or better.

- Note: Fractional shares can only be purchased or sold using Market orders.

Note: If you’re looking to use advanced order types (including trailing stop orders, bracket orders, etc.), please use Questrade Edge Web.

- Enter the quantity of shares that you want to sell, and for limit orders the limit price at which you would like to sell them.

- Since market orders sell for the best available price, the price field will not show up when selling by market order.

- You can change the account you would like to use to place the order from the drop-down.

- After you review all the details, click Send order to place your trade.

- If you are placing a limit order, you can use the drop-down here to set the order duration.

- If you’re satisfied with the order details, click Send order to place your trade.

Orders

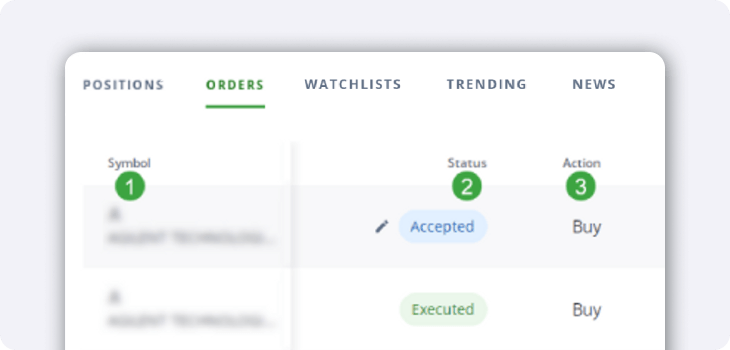

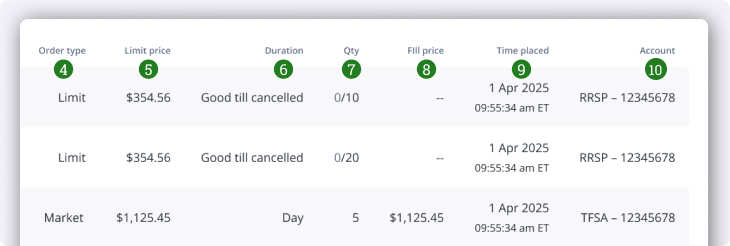

On the trading page, just below the chart and balances, is the Orders table showing your recent orders and statuses.

- The first column shows the Symbol and a description of the security.

- The Status column shows the order’s status. These are the available options:

- Accepted means the order has been sent to and received by the relevant exchange, but you do not own the stock or ETF yet. The order waits for a matching Bid or Ask before it either executes or expires.

- Accepted orders can be adjusted using the pencil icon.

- Orders for fractional shares cannot currently be modified. They must be cancelled and resubmitted.

- Executed means that the order has been successfully completed. At this point, you own the stock or ETF, and the order can no longer be modified.

- Replaced shows when an order has been replaced by another order.

- Cancelled refers to an order that has been cancelled outright.

- Accepted means the order has been sent to and received by the relevant exchange, but you do not own the stock or ETF yet. The order waits for a matching Bid or Ask before it either executes or expires.

- The Action column shows whether it was a Buy or Sell order.

- Order type shows what type of order was used (Market, limit or other).

- Check this article out for more information about order types.

- The Limit price column shows the limit price you bought or sold at (if a limit order was used).

- Duration shows what order duration was used for the order (DAY, GTC, etc.).

- Check this article out for more information about order durations.

- Qty shows how many shares were bought or sold, and how much of the order filled.

- Some large orders may fill in multiple stages if a single Bid or Ask isn’t large enough to accommodate how many shares you buy or sell.

- The fill price shows what the final fill (or execution) price was for the order.

- Time and date is the last column which shows the time the order was placed.

- Account is the account in which the trade took place.

Tip: If you click on any table header (i.e. Symbol, status, etc.) you can customize the view and order by ascending or descending.

If you’re looking to use advanced order types (including trailing stop orders, bracket orders, etc.) and durations, please use Questrade Edge Web.

Trading during Extended and Overnight trading sessions

Take advantage of Extended (which includes Pre-Market and Post-Market hours) and Overnight trading opportunities within the Questrade Trading platform.

North American stock markets operate from 9:30 am to 4:00 pm ET, Monday to Friday. There are also 2 separate trading sessions where you can continue to trade outside of regular trading hours: Extended markets trading (which includes pre-market and post-market) and Overnight trading.

To set your order to activate during extended market hours (4am- 930am and 4pm - 8pm ET) on the Questrade trading platform:

- Select a limit order from the Order entry window on the Trading page (as described above in step 4).

- Click on the order duration and change it to Good till ext. market (GTEM),

then place your order.

- Good till ext. market means your trade order remains active for the entire trading day, from 4am - 8pm, including during regular market hours. If it is not filled by 8pm, it will be cancelled.

To set your order to activate during overnight market hours (8pm - 2am ET) on the Questrade trading platform:

- Select a limit order from the Order entry window on the Trading page (as described above in step 4).

- Click on the order duration and change it to Overnight,

then place your order.

- Overnight means your trade order will remain active only between 8pm and 2am ET. If it is not filled by 2am, it will be cancelled.

Learn more about order types and durations.

Pre-market and overnight trading for Canadian securities is unavailable, and there are only limited options for post-market trading of Canadian stocks and ETFs.

Disclaimer: Securities shown are for illustrative, educational, and visual purposes only, and should not be relied upon as financial advice. The information provided is not intended to be and should not be construed as a recommendation, offer, or solicitation to buy or sell.

Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.